Governance Structure

Who we are > Governance

Governance Structure

Who we are > Governance

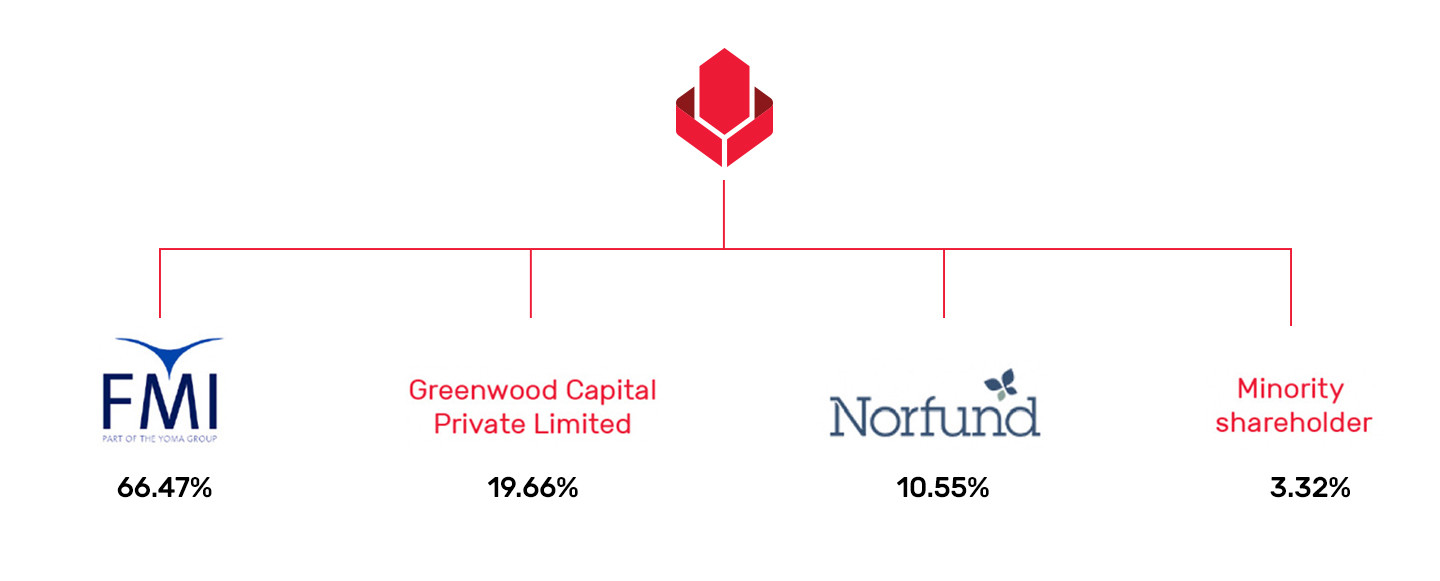

The shareholders of Yoma Bank are FMI, Greenwood Capital Private Limited (an affiliate of GIC), and Norfund, the Norwegian Investment Fund for Developing Countries. The composition of our Board of Directors evolves in accordance with the changes in the shareholding structure.

Annual General meetings are usually chaired by the Chairman of the Board. During these meetings, the shareholders:

- elect the Directors of the Board

- approve the remuneration of the Directors based on the recommendation of the Board

- appoint External Auditors

- approve the change in the share capital

- validate the allocation of the Banks’ resources.

Our 30th and most recent General Meeting was held on 29th October 2024 with our shareholders, Board Members and External Auditors. The notice of this meeting can be downloaded here.

The table below summarises the Annual General Meeting resolutions which were passed by way of written resolutions of 100% of the members according to section 156(d) of the Myanmar Companies Law 2017.

| Resolution | % for | % against | & abstention |

| A. Appointment of External Auditor (FY 2024-2025) | 100% | – | – |

| B. Appointment of U Tun Myat (Chairman) | 100% | – | – |

| C. Appointment of U Kyi Aye (Director) | 100% | – | – |

| D. Appointment of U Kyaw Soe Lin (Director) | 100% | – | – |

| E. Appointment of Mr. Chintaman Mahadeo Dixit (Independent Non-Executive Director) | 100% | – | – |

| F. Appointment of Mr. John Alan Staley (Independent Non-Executive Director) | 100% | – | – |

| G. Acknowledgement of resignation of Directors | 100% | – | – |

The Board is elected by and accountable to the shareholders of Yoma Bank. Pursuant to CBM directive no. (9/2019), the appointment of the Directors of the Board shall be staggered to ensure that the duties and functions of the Board are conducted without interruption. Except for decisions explicitly reserved for shareholders, the Board has full authority to carry out all activities necessary to provide effective strategic guidance and sound oversight, key personnel decisions, organizational structure, governance framework and practices, risk management and compliance obligations.

The following are the primary roles and responsibilities of the Board:

| Theme | Responsibilities |

| Board |

|

| Strategy |

|

| Risk & controls |

|

| Reporting |

|

| Stakeholders |

|

| People |

|

Board Performance Evaluation

- Authorities and General Information, which assesses the Board’s authorities, roles and consideration in protecting the Bank’s interest and the shareholders’ value as well as the Board’s effectiveness in guiding and setting the strategy of the Bank and managing the performance of the Chief Executive Officer.

- Board Composition, which looks at the composition of the Board and its sub-committees.

- Structure and Committees, which covers the structure, composition, effectiveness of committees, and the deliberations of committees to non-committee members.

- Duties and Liabilities, which appraises the communication to the Board on duties of loyalty, care and business judgement, learning about the Bank’s business, challenging, and asking critical questions to management, and disclosure of conflict of interest; and

- Working Procedures, which considers the working procedures of the Bank.

Related Party Transactions

It is policy of Yoma Bank that related party transactions are conducted at arm’s length with any consideration paid or received by the Bank in connection with any such transaction being on terms no less favorable than terms available to any unconnected third party under the same or similar circumstances. The Audit Committee oversees and reviews the propriety of related party transactions to avoid any potential or actual conflict of interest. The Bank has formulated guidelines for identification of related parties and the proper conduct and documentation of all related party transactions. The objectives are to set out (a) the materiality thresholds for related party transactions and (b) ensure proper approval, disclosure, and reporting of such transactions as applicable under the law/ regulations, between the Bank and any of its related parties in the best interest of the Bank and its Stakeholders.

Succession Planning

The responsibilities of the Chairman are:

- leading the Board and ensuring its effectiveness:

– Board Meetings are duly planned, chaired and documented

– Board members receive sufficient information timely before making a decision

– Board Committees function properly

– Board Members satisfy their duties

– The performance of the Board Members and of the Management Team is evaluated yearly at least - promoting a culture of openness and debate

– Board Members should have the opportunity to share their views and opinions freely - Ensuring that all the Board Members receive sufficient training to maintain and develop their understanding of the business environment of the Bank:

– new Board Members should be onboarded properly when they are elected

– existing Board Members shall have access to a continuous education program

The Audit Committee (AC) is responsible for:

- safeguarding the integrity of internal controls and financial reporting

- monitoring the effectiveness and performance of the Internal Auditor and External Auditors

- ensuring compliance with relevant laws and regulations

The following table summarises the main areas of responsibilities of the Audit Committee:

| Theme | Responsibilities |

| Compliance |

|

| Risk & Controls |

|

| Reporting |

|

- the identification and definition of risks inherent to the Bank’s business and activities such as credit, market, operational, liquidity, reputational, strategic, etc.

- the effectiveness of the risk management framework and control environment of the Bank

| Theme | Responsibilities |

| Compliance |

|

| Risk & controls |

|

| Reporting |

|

The main responsibilities of the Committee will cover the oversight of the following:

| Theme | Responsibilities |

| Organisation |

|

| People |

|

The main responsibilities of the Committee will cover the oversight of the following:

| Theme | Responsibilities |

| Technology |

|

BizSpace Portal

BizSpace Portal SMART Credit Business Portal

SMART Credit Business Portal Payroll Portal

Payroll Portal Supply Chain Financing

Supply Chain Financing HP Dealer Portal

HP Dealer Portal